In the complex world of exchange-traded funds (ETFs), a sophisticated strategy known as “heartbeat trades” has been quietly revolutionizing how these investment vehicles manage their portfolios while maximizing tax efficiency. Named by analyst Elisabeth Kashner for their distinctive spike patterns that resemble an electrocardiogram, these transactions are becoming increasingly important in the ETF ecosystem—and they’re attracting both praise and scrutiny from regulators and critics alike.

Understanding Heartbeat Trades

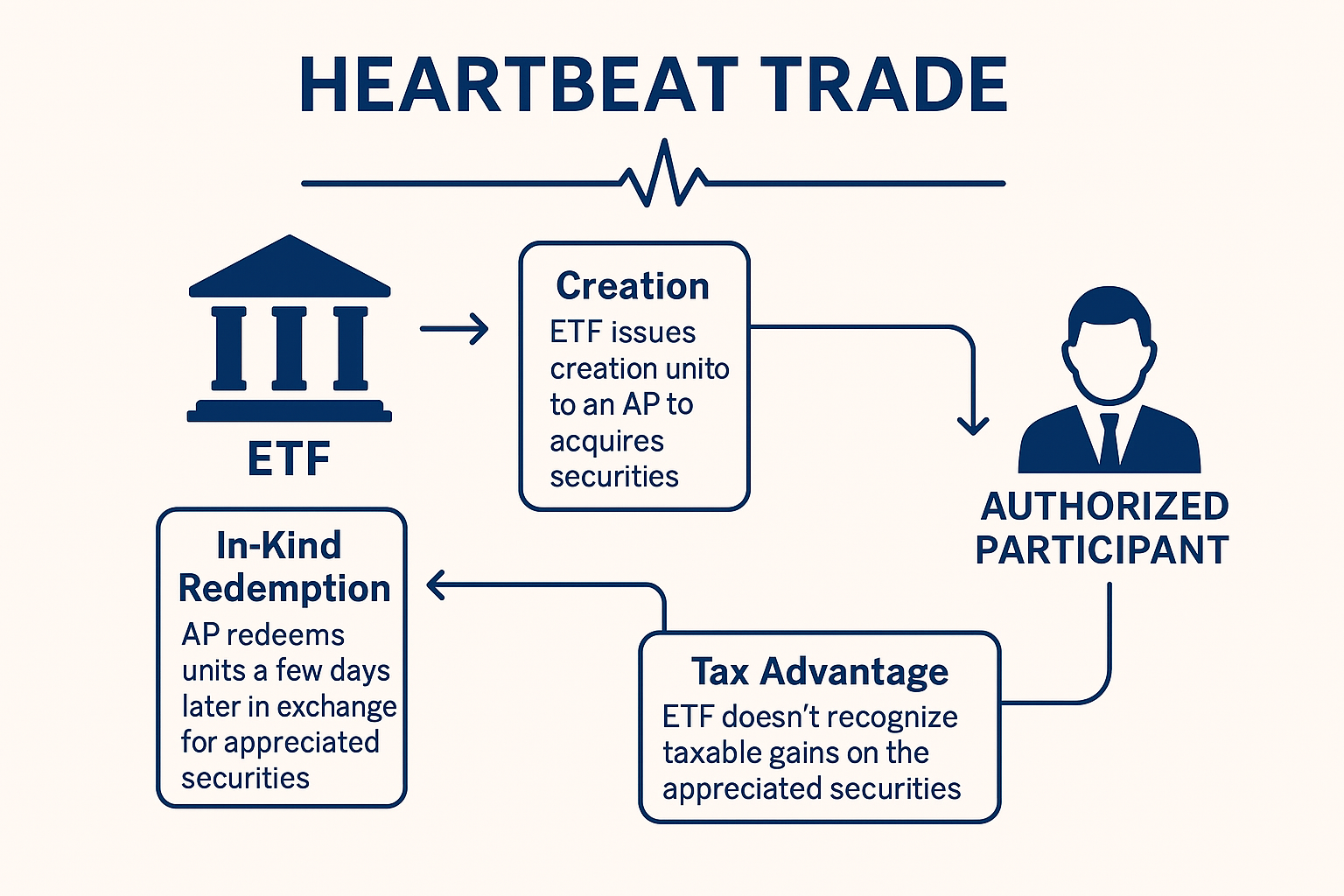

At their core, heartbeat trades are carefully orchestrated creation-and-redemption transactions that allow ETFs to adjust their holdings without triggering taxable capital gains. This mechanism relies on a partnership between ETFs and their Authorized Participants (APs)—typically large banks or financial institutions that have the unique ability to create and redeem ETF shares directly with the fund.

The primary goals of heartbeat trades are straightforward yet powerful: they help ETFs sidestep capital gains taxes on appreciated assets, enable portfolio rebalancing following index changes or mergers, and maintain the low turnover that gives ETFs a significant tax advantage over traditional mutual funds.

The Mechanics Behind the Magic

The heartbeat trade process unfolds in two coordinated steps that, while appearing independent, work together strategically:

First, the ETF issues new shares (called “creation units”) to an Authorized Participant in exchange for a basket of securities the fund wants to acquire. Shortly afterward, the AP redeems those same shares, but here’s where the tax efficiency comes into play: instead of receiving the same securities back, the ETF delivers different appreciated securities—often low-basis positions it wants to remove from its portfolio—through what are known as “custom baskets.”

This in-kind redemption process is made possible by SEC Rule 6c-11, which allows ETFs to customize the basket of securities they deliver during redemptions rather than providing a pro-rata slice of their entire portfolio.

The Tax Advantage: Section 852(b)(6)

The real power of heartbeat trades lies in their interaction with Section 852(b)(6) of the Internal Revenue Code. This provision allows ETFs to distribute appreciated securities to Authorized Participants without recognizing taxable gains on those transactions.

Through this mechanism, ETFs can effectively swap out low-basis, high-gain positions without triggering tax events. Over time, this process allows funds to “wash out” unrealized gains, significantly boosting after-tax returns for shareholders. It’s a sophisticated form of tax management that would be impossible for individual investors or traditional mutual funds to replicate.

Growing Controversy and Criticism

Despite their elegance from a tax perspective, heartbeat trades have not escaped criticism. Detractors argue that these transactions are essentially “sham redemptions”—sophisticated tax-avoidance strategies dressed up as legitimate business transactions.

The stakes are significant: estimates suggest that heartbeat trades may be costing the U.S. Treasury tens of billions of dollars in lost tax revenue annually. Critics also point out that the benefits are disproportionately skewed toward high-net-worth investors who are more likely to hold ETFs in taxable accounts where these tax advantages matter most.

Legal scholars have raised concerns about the “step transaction doctrine,” suggesting that the IRS could potentially challenge heartbeat trades by arguing that the creation and redemption steps are so interconnected that they should be treated as a single taxable transaction rather than separate events.

The Regulatory Environment

The regulatory landscape around heartbeat trades continues to evolve. SEC Rule 6c-11, implemented in 2019, standardized ETF operations and explicitly permitted the use of custom baskets, effectively facilitating heartbeat trades. While the rule wasn’t specifically designed to endorse this tax strategy, it has made execution smoother, particularly for actively managed ETFs that rely heavily on this mechanism.

The IRS, meanwhile, has not officially challenged heartbeat trades, likely weighing enforcement concerns against the potential disruption to the broader ETF market. However, practitioners should remain vigilant, as legal or regulatory reevaluation remains a possibility as these trades become more widespread and visible.

Market Adoption and Future Outlook

Heartbeat trades are no longer an obscure corner of the ETF world. Research has identified over 2,200 instances involving more than $330 billion in volume since 2000, and their use is increasing alongside other tax-optimization strategies like Section 351 conversions.

As bull markets create more embedded gains in ETF portfolios, mainstream adoption of heartbeat trades is expected to accelerate. This trend has important implications for financial advisors and asset managers, who should consider highlighting ETF tax efficiency as a key value proposition for clients while staying informed about ongoing legislative and regulatory developments.

Strategic Considerations

For investment professionals, heartbeat trades represent both an opportunity and a responsibility. The tax efficiency they provide can be a significant advantage in client portfolios, particularly in taxable accounts. However, the complexity and potential regulatory risks suggest that coordination with tax counsel is essential when implementing rebalancing strategies that rely on these mechanisms.

As the ETF industry continues to mature and evolve, heartbeat trades are likely to remain a critical tool for portfolio management and tax optimization. Understanding how they work—and their potential limitations—will be essential for anyone involved in modern portfolio construction and management.

The future of heartbeat trades will likely depend on the ongoing balance between their clear benefits for investors and the legitimate concerns about tax avoidance and regulatory oversight. For now, they remain a powerful example of financial innovation working within existing regulatory frameworks to benefit investors, even as they push the boundaries of traditional tax policy.