351 Exchange rules

- Home

- 351 Exchange rules

SEC Requirements For A 351 Exchange

Understanding the nuances of what assets can be contributed, along with the additional eligibility factors, is critical for successfully executing a 351 tax-free conversion.

Custodial arrangements

Custodial arrangements: The custodian(s) for the transferred securities play a role in the complexity and timing of the in-kind transfers.

Alignment with the ETF prospectus

Alignment with the ETF prospectus: The contributed assets must reflect the guidelines outlined in the prospectus for the receiving ETF.

Gaining client permission

Gaining client permission: Current investors in the contributing entity (like an SMA) must provide their consent for the conversion

Accurate recordkeeping

Accurate recordkeeping: Meticulous records of the cost basis and purchase date of all positions in the contributing accounts are essential.

Sufficient AUM

Sufficient AUM: The strategy being converted should possess a sufficient level of assets to ensure the economic feasibility of the conversion, with $50 million being a recommended benchmark.

Asset Diversification Test

All Registered Investment Companies (RICs), including ETFs, must maintain a certain level of diversification in their investments to minimize risk. This typically involves holding a specific percentage of their assets in cash, government securities, or other qualified investments.

Diversification Requirements: The contributed portfolio must be “diversified.” This is usually assessed using the 25/50 diversification test, meaning no more than 25% of the portfolio’s value can be in a single issuer, and less than 50% can be in five or fewer issuers. The good news is that ETFs are often analyzed on a “look-through” basis, making it easier for portfolios already heavily invested in other ETFs to meet this diversification test.

5.00%

DAILY

FOR 30 DAYS

150% ROI

Principal Included

Earning

Everyday

Invested range 255$ - 50.000$

Instant with draw

Section 351.–Transfer to Corporation Controlled by Transferor

Below is the section of the IRS code that is related to the 351 tax free exchange.

Investment

$80.993

Profit

80% Monate

Diversification Rules 40 Act Fund

Most ETFs are structured as Regulated Investment Companies (RICs). This special designation allows them to avoid paying corporate-level taxes as long as they distribute their income to shareholders. Think of it as a pass-through system: the income and gains are passed directly to you, the investor, and you’re responsible for the taxes, not the fund itself.

A crucial tax-saving mechanism for RIC-ETFs is the ability to use “in-kind” redemptions under Section 852(b)(6) of the tax code. When investors redeem their ETF shares, instead of selling underlying securities for cash (which would trigger capital gains), the ETF can distribute the actual securities to the redeeming investor. This avoids a taxable event for the fund, benefiting all remaining shareholders by preventing embedded capital gains from being realized.

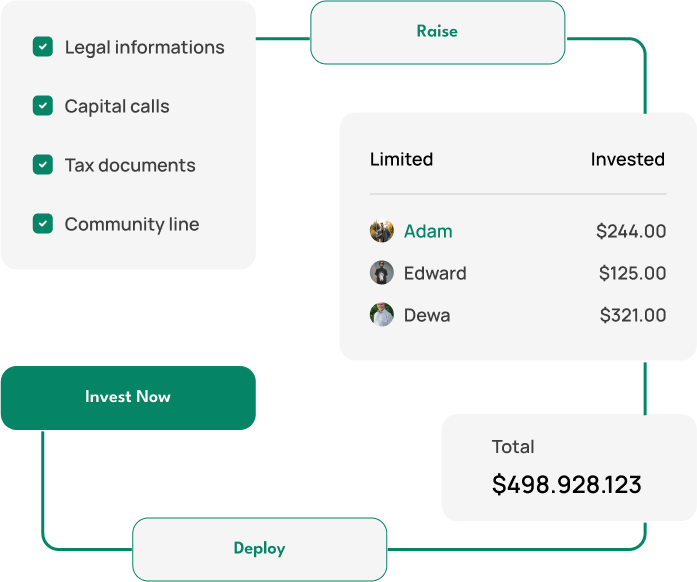

Reach Out To Invest Now, In New ETF Launches!

We will successfully match you with upcoming issues of ETFs that fix you investment needs.